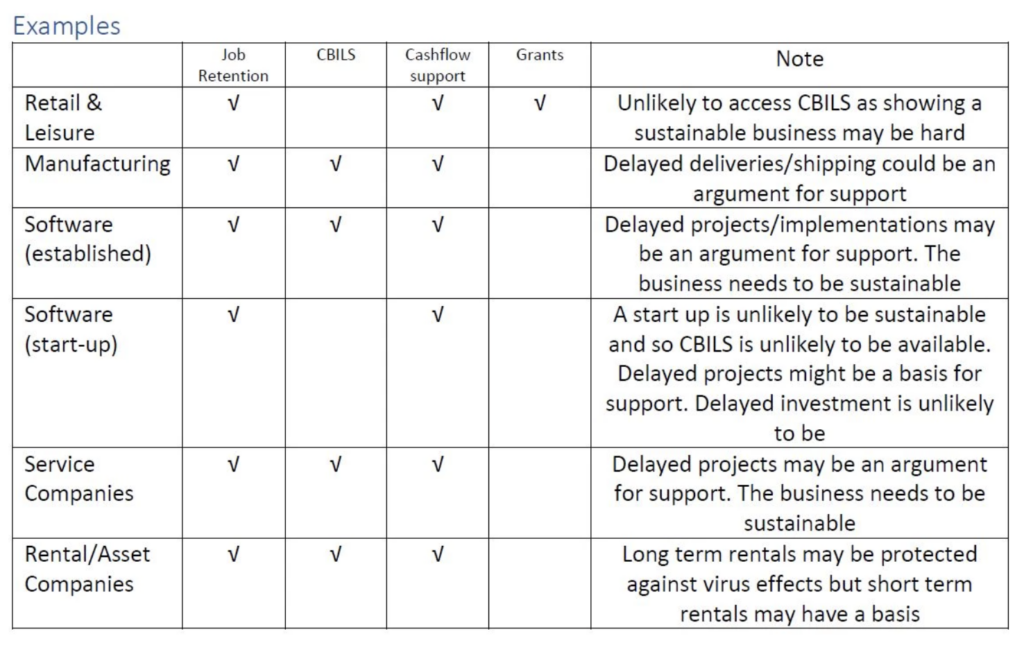

Following the recent announcements by the Government, we thought it would be useful to summarise the advice and support available for businesses.

Job Retention Scheme:

- HMRC arranged grant to support up to 80% of an employee’s wages (capped at £2,500).

- This would start from March 1st and last for 3 months

- It’s expected that payments would be available from the end of April. Company can pay 80% and can choose whether to top up the 20% or not. The company has to pay the salary and recover from Government which could be six to eight weeks of cashflow impact.

- Affected employees would be those who would have been laid off or made redundant because of the impact of the virus on trading. Employees must not work in order to qualify. This probably means that owner managers aren’t eligible. Anyone making use of temporary homeworkers now has to decide whether to carry on or “furlough.” Workers who have been laid off could be “unlaid” off in order to qualify for the scheme.

- It’s not clear whether variable or zero-hours workers could claim but it occurs to us that the holiday pay mechanism (earnings averaged over 12 weeks) could be used.

- This support is available to businesses of all sizes.

COVID-19 Business Interruption Loan Scheme (“CBILS”):

- There have been various announcements but we are now seeing lenders announce specific loan application criteria.

- Please see our application worksheet based on the criteria set out by Lloyds Bank. The Lloyds criteria is based on 2019 sales and people costs. Growing companies will struggle to use their “best” numbers in an application with some flexibility from a bank (are your 2019 numbers the files accounts for 2019 or the ones with most of 2019 included?)

- The Lloyds application process seems manual and requires a form to be downloaded from the website and submitted by email. The Barclays scheme is phone based.

- It’s clear that you have a relationship with a bank in order to apply. Traditional banks and challenger banks appear to plan to have loan products available under CBILS but not all have launched yet.

- There are marketplace lenders who seem to be outside the scheme.

- It’s tempting to arrange finance at any cost but businesses need to be comfortable that they can repay the debt that they take. The CBILS scheme might make things easier but not all businesses will be eligible.

It will be incumbent on businesses to prove that they have a short-term problem but are viable in the longer term. A robust financial model is critical to this and also to assure a business owner that the debt could be repaid. Few businesses could, as an example, exist with revenue for, say, 6 months and no one yet knows the economic impact of the lockdown. In broad terms, the scheme

- Existing banks and financial institutions will make available (with guarantees from the British Business Bank – in the same way that people may recall that the Small Firm’s Loan Guarantee Scheme worked) facilities such as

- Term facilities

- Overdrafts

- Invoice finance facilities

- Asset finance facilities

- To qualify, applicants must

- Be UK based, with turnover of no more than £45 million per annum

- Operate within an eligible industrial sector (a small number of industrial sectors are not eligible for support or subject to limitations)

- Be able to confirm that they have not received de minimis State aid beyond €200,000 equivalent over the current and previous two fiscal years

- be unable to meet a lender’s normal lending requirements for a fully commercial loan or other facility, but would be considered viable in the longer-term

Use our eligibility checker to find out more.

It’s likely that banks will be inundated and so we suggest that businesses actively manage their cashflow whilst arranging facilities.

Cashflow Support:

- All VAT will be deferred from the next quarter (so no VAT will be paid by business until the end of June) and that deferment will be made back up by the business by the end of 2020.

- Self-assessment tax payments will be suspended for the next quarter. This realistically means that the July instalment will be deferred until the end of the year.

Grant support:

- Retail/leisure/hospitality: These sectors are eligible for cash grants – and the money is coming through local authorities. This will be distributed by the local authority who will receive the funds from Government shortly.

- “Retail” is clearly defined (by SIC code and existing retail discounts on business rates) but “leisure and hospitality” have yet to be defined by Government.

- The best way to check whether you are eligible for a £10K or £25K grant is to pull out your most recent rates bill and look for the “rateable value” – it will typically be part of the rates bill calculation e.g. “22,000*0.49 = £10,780” where 22,000 is the rateable value and £10,780 is the rates bill.

- If you are under £51,000 of rateable value (not rates bill) then you qualify for a grant. If you get any small business rates relief (typically for rateable values under £15K) it will be shown on your rates bill – then you will receive the £10K grant. If you do not receive small business rates relief then you should qualify for £25K.

- If you are a business with a cafe it could be very worthwhile checking your SIC codes here:

- https://www.gov.uk/get-information-about-a-company and checking that you are registered as a retailer, or as licensed or unlicensed restaurant.

Accounting controls:

- It might not be top of the agenda but losing the funding you already have, through fraud or theft, would make things a lot worse.

- We often see small businesses share passwords, accept ad hoc invoices and be flexible on payment information.

- Economic uncertainty always sees an increase in theft & fraud.

Please guard against this & talk to the team at Practical CFO if you need any further advice.

At PCFO, we help ambitious businesses grow by acting on opportunities and mitigating risk by providing outsourced FD and CFO services. We support and advise on building and presenting helpful management accounts which will enable businesses to make the right decisions, at the right time. Find out more about how we can help your business to succeed by speaking to our team.